https://www.slab.org.uk/news/covid-19-guidance-note-on-assessment-of-civil-criminal-childrens-and-abwor-accounts/

https://www.slab.org.uk/news/covid-19-guidance-note-on-assessment-of-civil-criminal-childrens-and-abwor-accounts/

30 June 2020

This guidance note provides information about our approach to the assessment of an account or fee claim which includes charges in relation to written representations/submissions, which are ordered by the court (or tribunal) to be prepared as a direct alternative to, and displacing the requirement for, an oral hearing during the Covid-19 emergency.

[This section updated 3 August 2022]

Written submissions and Notes of Argument are traditionally documents that will be lodged in court to complement the oral advocacy.

This guidance does not apply to any such cases but in passing it is confirmed that those documents, whether one or both are required by the courts, will continue to be payable at either the prescribed framing charge, where appropriate, relevant to the type of legal aid or ABWOR that is being provided.

Where the work is undertaken by counsel and there is no prescribed fee for this work we will continue to apply the historical approach to taxation for such documents in order to arrive at the reasonable fee payable.

No separate fee is payable for written submissions in a Schedule 6 block fee case where a hearing takes place either in person or by electronic means. However, if the level of work involved in the drafting of the submissions results in the Schedule 6 block fees no longer providing reasonable remuneration for the work actually, necessarily and reasonably done then it is open to the solicitor to make an application for exceptional case status.

If granted the account must then be charged on the basis of Schedule 5 detailed fees but that provides the flexibility that allows for charges to be made for all work reasonably done in the case.

The various tables of fees do not presently provide specific fees for the preparation of written representations in circumstances where those documents directly replace the court hearing.

The traditional framing charge associated with the drafting of documents may produce unrealistic and possibly unfair levels of payment for the work actually required for such written representations, and having regard to the equivalent advocacy fee that would normally be chargeable by the solicitor or counsel physically conducting the hearing.

Allowing a framing fee alone for the drafting of the representations may provide unreasonably low payment for the amount of time spent in their preparation.

This guidance covers the approach that SLAB will take where the written representations directly replace and substitute the need for any separate hearing or oral advocacy.

In circumstances where a Note of Argument has also been required by the court in advance of any supplementary written representations this work will be payable separately subject to the statutory tests of taxation.

It is understood that the written representations that the court requires are expected to provide a comprehensive and focussed submission on the points which would require to be addressed had the hearing taken place, including the legal argument in response to submissions lodged by all other parties to the proceedings. This will allow the court to reach an informed decision on the relevant issues in dispute.

The drafting of these documents may take longer than oral presentation depending on the nature of the issues in dispute as it will effectively combine both the preparation and representation elements that will ordinarily be associated with a hearing. SLAB also understands and appreciates that the time and resource required is likely to vary from case to case.

In the absence of any prescribed fee and during the Covid- 19 pandemic you are not restricted to a framing charge for written representations where the hearing is dealt with “on the papers” as a directed alternative to what would be a physical hearing.

Subject to the restrictions outlined in the later detailed comments, you may elect to charge the reasonable time engaged in the framing of the submissions. Again, subject to the differences driven by the distinctions between different legal aid fee tables, you may be able to claim some time at the relevant “conduct” or “advocacy” fee, relevant to the type of legal aid or ABWOR which is being provided.

Some fee tables allow a separate “additional” preparation charge where circumstances ordinarily permit. In the Covid-19 circumstances to which this guidance applies, the focus is on paying a reasonable fee for the actual time reasonably spent in what is preparation work, whatever that is.

We would therefore anticipate that additional preparation would not ordinarily figure as a separate element. The whole thing is preparation. By definition there is no actual court attendance – only the work of preparing the written representations.

In any circumstances where a separate “additional” preparation charge is possible, and it is considered appropriate that a claim is made in addition to the reasonable charge made for preparing the written representations, it is essential that you clarify what additional preparation work was undertaken that is not already incorporated into the reasonable time it took to frame the written representations.

Without this information, we will not be able to assess the claim, and no payment can be made in respect of any element which otherwise presents as double accounting or overlap in, or the duplication of, the payment claim for the work.

As a pointer to the appropriateness of an additional charge for preparation, we will look at cases where such a charge would have been justified had a hearing proceeded.

We will require to establish, as far as is possible, whether the amount claimed represents a reasonable fee for the work that would be involved in preparing the representations.

Our intention is to apply as consistent an approach as is possible to the assessment of solicitors and counsels fees mindful of the need to have regard to the different payment arrangements (block/detailed/fixed/standard) that can apply and whether separate preparation fees would have been payable had the solicitor or counsel attended an oral court hearing.

You should provide a copy of the written representations when submitting your claim.

While the process of assessment is subjective we must apply and have regard to the Act, regulations and taxation policy and practice (where this exists) in a way which is consistent and provides fair and reasonable remuneration.

The use of hours worked multiplied by the hourly rate will seldom, in isolation, be helpful in determining the reasonable fee payable. Only the time reasonably expended is payable, otherwise the inefficient or slow worker gets a higher level of remuneration than the efficient worker.

Accordingly, in any case where the time taken to frame the written representations significantly exceeds the time to prepare and conduct the equivalent oral hearing it is essential that you provide a detailed note as to the reasons why in support of your claim. Failure to do so may result in restrictions being made to the account.

The time reasonably engaged in the framing of the written representations will be chargeable at the relevant conduct rate.

However, as the drafting of the written representations will effectively combine both the preparation and representation elements we would not anticipate any separate preparation charge being made in the account.

Where a separate preparation charge is claimed you must provide details of the separate preparation that has been undertaken to ensure that there is no duplication of time between the separate preparation and the time being allowed for the associated framing of the submissions which is being paid at the enhanced advocacy rate.

A failure to provide this information is likely to result in restrictions being made to the claim.

In solemn proceedings a prescribed preparation fee in schedule 1, paragraph 4A, is payable for the following hearings:

In the event that any such hearing is conducted by written representations the time reasonably engaged in framing written representations in excess of the 30 minute preparation time allowable will be payable as conduct time.

In solemn proceedings where a hearing is of a type that results in the fee being chargeable in accordance with Schedule 1, part 2, paragraph 6, the inclusive fee will be deemed to cover the first 30 minutes of time engaged in the framing of any written representations. The excess time engaged will be payable as conduct time subject to the tests of reasonableness.

The fixed payment covers all work undertaken in the case with the exception of where separate prescribed “add-on” fees are payable for various court hearings.

The prescribed “add-on” fee will continue to be paid for any relevant hearing in the unlikely event that they are conducted by way of written representations.

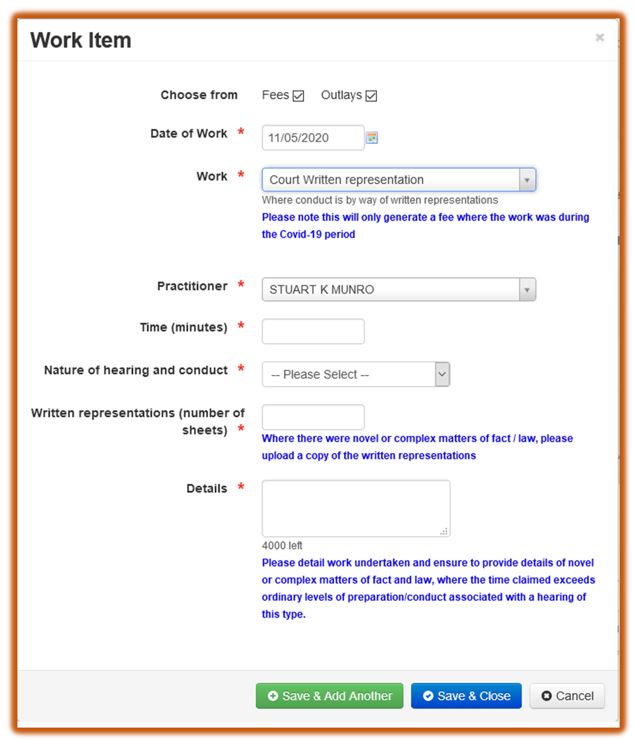

For online accounts a new work item Written Representations has been created within the appropriate fee tables for conduct at court.

Within this work item you can claim for the reasonable time engaged in such work. You should provide a note of the sheetage involved and provide details of the work undertaken including details of any novel or complex matters of fact or law.

Please note this work item can only be claimed from 1 April 2020.

Should you attempt to claim prior to this the work item fields will not display and you will be unable to claim a fee.

Should the work item details not display, please check the date you have entered for the work item.

A screenshot display in relation to a criminal detailed account is shown below for illustrative purposes. The online system may vary slightly depending on the type of account that you will submit.

For paper accounts you should provide a supporting narrative and only charge at the relevant conduct rate in circumstances where the framing of written representations replace the need for any oral hearing.

Where a hearing is conducted by way of written representations the time reasonably engaged in the framing of the written representations will be payable as conduct time subject to the following conditions.

Where the hearing is payable on a “per day” basis: the prescribed “per day” fee is anticipated to be sufficient, in the overwhelming majority of cases, to cover the time reasonably engaged in framing written representations associated with the hearing.

In circumstances where the time engaged exceeds a day then the excess will be assessed in accordance with the provisions in relation to preparation.

For all other hearings which are payable based on the duration of the hearing, in 30 minute tranches, the time reasonably engaged in the framing of the written representations will be payable as conduct time.

The criminal fees regulations prescribe a standard fee depending on the status of counsel and nature of the hearing. That fee will continue to be payable for any hearing which is conducted by way of written representations.

In circumstances where the time engaged exceeds a day then the excess will be assessed in accordance with the provisions in relation to preparation.

If you have any queries on the update, please contact:

Steven Carrie, Senior Technical Specialist: carriest@slab.org.uk

All solicitor updates

29 November 2024

This update offers guidance and support for submitting interim claims for fees and outlays prior to the conclusion of cases/completion of the proceedings